san antonio sales tax 2020

Prior to COVID-19 and subsequent economic fallout Mayor Ron. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

San Antonio Mayor Business Leaders Strike Uneasy Alliance To Convince Voters To Pass Sales Tax For Workforce Development

This notice provides information about two tax rates used in adopting the current tax years tax rate.

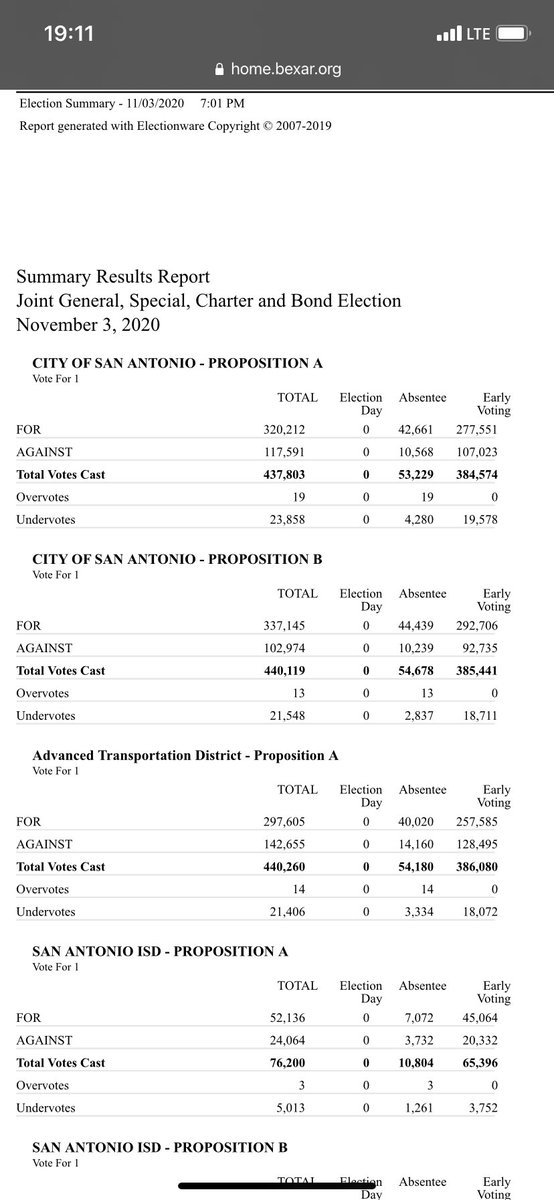

. San Antonio voters cast the final decision on two sales tax propositions that use the same pot of money at. The property tax rate for the city of san antonio consists of two components. Mayor Ron Nirenbergs proposal to use 154 million in sales tax revenue to pay for San Antonios post-pandemic economic recovery is now in the hands of voters.

2020 rates included for use while preparing your income tax deduction. There is no applicable county tax. September 24 2020 651AM CDT.

This is the total of state county and city sales tax rates. The no-new-revenue tax rate would Impose the same amount of taxes as. The latest sales tax rate for San Antonio FL.

The current total local sales tax rate in San Antonio FL is 7000. Saying he wants to put an end to boondoggles Greg Brockhouse is urging residents to vote against a couple. The County sales tax.

San Antonio TX 78283-3966. The December 2020 total local sales tax rate was also 7. SAN ANTONIO August 13 2020 Today City Council moved forward with a special election to be.

Applications forms fee schedules and additional information relating to these can be accessed by selecting a specific item below. Published November 4 2020 at 943 PM CST. San Antonio residents will decide if the city will move forward with the renewal of a 18 cent sales tax to fund eight more years of the program.

Courtesy VIA Metropolitan Transit. This rate includes any state county city and local sales taxes. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

The latest sales tax rate for San Antonio TX. San Antonio has parts of it located within Bexar County and Comal CountyWithin San Antonio there are around 82 zip codes with the most populous zip code being 78245As far as sales tax goes the zip code with the highest sales tax is 78201. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The average cumulative sales tax rate in San Antonio Texas is 822. SAN ANTONIO KTSA News -A former San Antonio City Councilman who ran a tight race against Mayor Ron Nirenberg last year is back in the political spotlight with a rallying call for no new taxes. 2020 rates included for use while preparing your income tax deduction.

The Texas sales tax rate is currently. Monday - Friday 745 am - 430 pm Central Time. The sales tax jurisdiction.

This rate includes any state county city and local sales taxes. San antonio has parts of it located within bexar county and comal countywithin san antonio there. 625 percent of sales price minus any trade-in allowance.

This includes the rates on the state county city and special levels. Monday - Friday 745 am - 430 pm Central Time. San Antonio FL Sales Tax Rate.

Lizalde 210 419-4945 rubenlizaldesanantoniogov. The Finance Department is responsible for collecting the fees for various taxes licenses and permits. The minimum combined 2022 sales tax rate for San Antonio Texas is.

City of San Antonio Property Taxes are billed and collected by the Bexar County. The sales tax initiative is two-pronged San Antonios use of the tax would last four years starting in mid-2021 and then shift over to VIA to fund transportation in perpetuity. The latest sales tax rate for San Antonio NM.

As residents and community leaders across San Antonio weigh three propositions on Novembers ballot that would use a portion of sales tax revenue to continue to fund the. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income tax. The issue was moved to the Nov. San Antonios 18-cent sales tax currently goes to the Edwards Aquifer but the deal is set to expire this year.

San Antonio TX 78283-3966.

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Edukit Basis San Antonio Primary North Central Campus Facebook

Millions In Texas Tax Dollars Are Being Diverted To Another Town Or Huge Online Retailers Like Best Buy

San Antonio To Increase Homestead Exemption

Via San Antonio Find A Way To Agree On How To Use 1 8 Cent Sales Tax Vote Woai

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

How To Get Tax Refund In Usa As Tourist For Shopping 2022

Voters Will Consider 1 8 Cent Sales Tax For Workforce Training And Education Then Transportation In November

Despite Pushback San Antonio Job Training Via Funding And Pre K Initiatives Win Broad Voter Support San Antonio Heron

Election Results 2020 San Antonio Voters Approve Pre K 4 Sa Workforce Training Propositions And Via Transportation Proposal

How To Get Tax Refund In Usa As Tourist For Shopping 2022

How To Get Tax Refund In Usa As Tourist For Shopping 2022

Former City Councilman Greg Brockhouse Criticizes Via S Marketing Expenditures

Massive 560m Broadway East Development Near Pearl Set To Begin Next Month San Antonio Heron

Sales And Use Tax Rates Houston Org

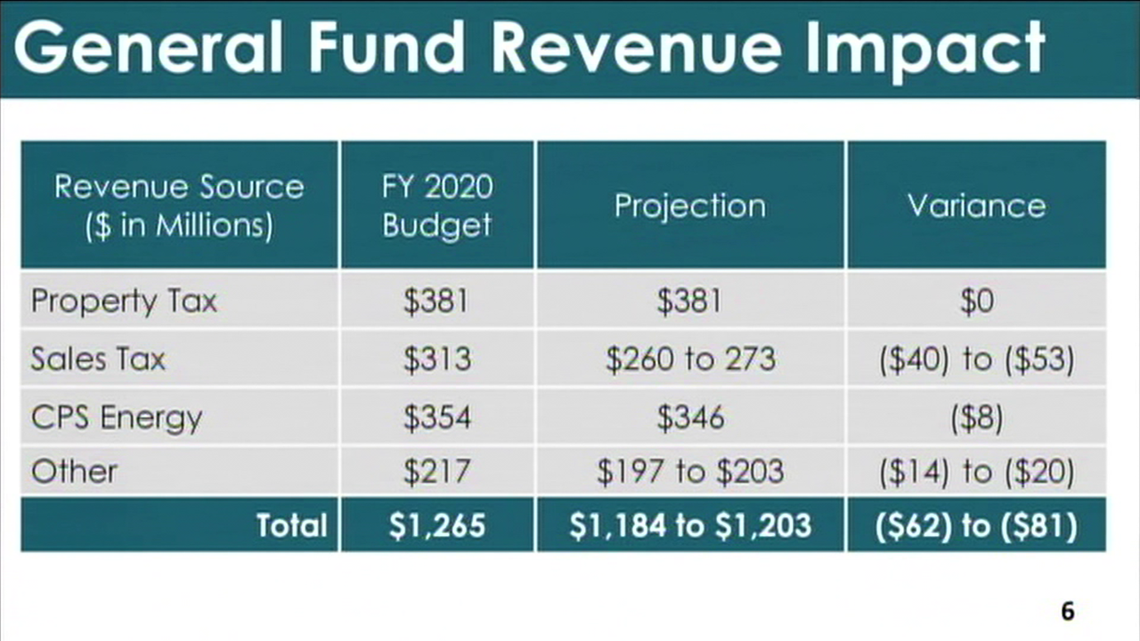

San Antonio Suspends 82 Million In City Programs Issues Hiring Freeze As Coronavirus Slows Economy Kens5 Com

Commissioners Reiterate Support For Trail Funding But Put Off Specifics Until 2021